Welcome to the HydraDX Monthly Update, where you can keep track of all things HydraDX. In conjunction with the monthly newsletter, live AMA Office Hours will be held in Discord during the following times on May 4th:

2pm UTC (7am/10am PST/EST; 10pm HKT/SGT)

7/10pm PST/EST (10am HKT/SGT - May 5th)

For those who are unable to attend Office Hours, there will be two 1-hour text-based AMA sessions occurring:

Chinese - 9pm HKT/SGT Thursday (May 4th) in WeChat

English - 11am UTC Friday (May 5th) in Discord

If you haven’t subscribed, join us:

Heads Down As Usual

Gm! Following an eventful March, the crypto market in general was more quiet in April. Here at HydraDX, our contributors continue to be heads down in shipping new features and integrations.

In April, the Protocol onboarded ZTG, the token of @ZeitgeistPM protocol, as our first-ever parachain asset in the Omnipool! Zeitgeist is a next-generation platform which offers users a fully decentralized prediction market on Polkadot. The protocol is dedicated to delivering precise forecasting data, ensuring you stay one step ahead in the game.

Having Zeitgeist as our first parachain treasury in the Omnipool, we expect momentum to continue for the next several months as some other well-known names begin to surface in the Omnipool. 👀

As usual if there is any feedback on what our team can do better, please do drop us a comment in Discord.

Without further adieu, let’s get into it! 🐉🐉🐉🌊🌊🌊

Key Protocol Updates

POL Diversification and Deployment (Q2+ 2023)

With an eventful Q1 2023 wrapped up, HydraDX is looking forward to Q2 2023 and beyond on how to deploy the remainder of the POL funds sourced from the LBP. Referendum #43 has now been passed following an active community discussion. The key list of actions for the diversification and deployment of the remaining liquidity are as follows:

Buy 1,000,000 DAI worth of HDX

Future use of the accumulated HDX to be discussed.

Buy 3,330,000 DAI worth of DOT (incl. LSDs)

Accumulated DOT to be split between the following use cases:

At least 1M DAI equivalent deployed to Omnipool as LP;

At least 1M DAI equivalent swapped for DOT LSDs (options to be explored) and to be deployed to the Omnipool as LP;

The remainder to be reserved for the next HydraDX parachain slot. Once the slot is secured, a discussion can decide how to utilize any remaining DOT.

Buy 500,000 DAI worth of iBTC

Deploy the accumulated iBTC into the Omnipool.

For further detail on the referendum, check 👉 here

Follow-up Q2 POL AMA

Following the recent governance proposal, HydraDX founder, Jakub Gregus, sat down with @lolmcshizz and had an AMA chat to answer questions. Unfortunately, there is no recording; however we have recapped the key points below:

Recap of the referendum

After DOT is acquired, first focus is to look into DOT LSDs with the first being Bifrost and testing out functionality

Buyback of HDX is expected to proceed following the implementation of HDX staking

Buybacks will be redistributed to HDX stakers

Expected to be commence in the next several quarters

HDX Staking - key to governance participation in order to prevent economic attacks

First version will only redistribute asset fees on Protocol’s own HDX POL

Researching to see if DCA feature would allow buyback to occur when large HDX sell orders take place

HydraDX will be proposing to utilize HDX from the treasury to fill the available LP position for HDX. This is part of the transition for the Protocol to be the only LP for HDX to prevent IL on individual LPs

Listing of ZTG, iBTC, and USDT

During the month, HydraDX listed three native Dotsama assets in the Omnipool, becoming the deepest source of trustless liquidity within the ecosystem for these respective assets.

ZTG is the token of the @ZeitgeistPM protocol - a decentralized prediction market protocol committed to producing accurate forecasting data on Polkadot.

This is the first-ever DEX listing for ZTG and the first Polkadot parachain asset in the Omnipool!

iBTC is the Polkadot native version of Bitcoin - @InterlayHQ’s flagship product which is a 1:1 Bitcoin-backed asset, fully collateralized, interoperable, and censorship-resistant.

USDT - the largest stablecoin by market capitalization, allowing for cross-ecosystem liquidity to flow seamlessly into the Polkadot ecosystem.

Start trading 👉 here

HydraDX completes ~$2.5M in OTC swaps

With the OTC desk feature live, the Protocol itself completed the first Polkadot-native OTC swaps from DAI to iBTC and USDT. This allowed HydraDX to obtain its target POL assets in a fully trustless and decentralized manner with the help of the community.

In the future, we foresee other protocols being able to leverage this feature via XCM to manage and diversify their treasury holdings, moving even more day-to-day activity on-chain and without a centralized counterparty.

Check it out 👉 here

Sama Days | The Evolution of DeFi on Polkadot

This past week, HydraDX founder, Jakub Gregus and @lolmcshizz also sat down with the Kusamarian for a fireside chat to answer questions on the state of DeFi on Polkadot. A recording of the AMA can be found on twitter here.

Development Progress Hub

A selection of development updates on various items in progress. The updates span over a month and is ordered chronologically (as much as possible) for each item.

Partnerships / Business Integrations / Operations

Project Treasury LP (a.k.a. Hydrate Your Treasury)

Partnering with interested parachains to deploy part of their token supply into the Omnipool as a LP to help reduce their liquidity budget

Onboarded Zeitgeist and their ZTG token into the Omnipool

Confirmed onboarding parachain tokens: Bifrost (currently voting to open HRMP channels) and Astar

Moonbeam has passed the governance proposal to open HRMP channels with HydraDX

Centrifuge is undergoing governance discussion to open HRMP channels with HydraDX

Polkadot Assurance Legion (PAL)

HydraDX is leading a new ecosystem initiative which will pool together funds to help parachains undergo rigorous audits.

Initial members of PAL include: HydraDX, Interlay, Astar Network, Manta Network, Bifrost, Acala, Centrifuge, Zeitgeist and Equilibrium.

Besides audits, PAL will drive the adoption of various methods for (formal) verification and the development of tooling.

Submitted proposal on 3/30 for the Polkadot treasury bounty for discussion here: https://polkadot.polkassembly.io/post/1752

Product Features / Cross-chain / Infrastructure

OTC Tradooooor

SHIPPED ✅

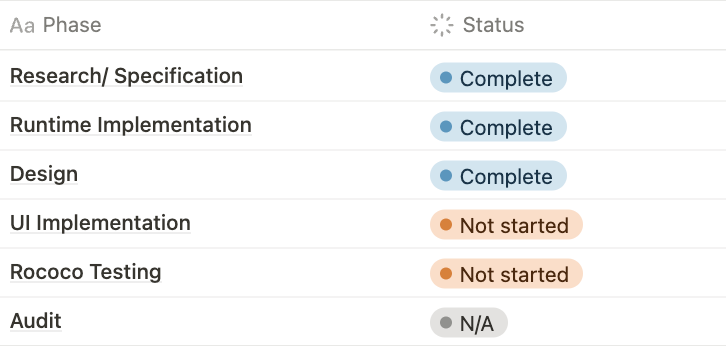

Dynamic Fees

Description: This feature allows the Protocol to be able to charge varying fees based on volatility (via. price and volume oracle data); this increases profitability for LPs, including HydraDX’s POL position, who are hit harder in volatile trading environments.

Notes:

Omnipool integration now complete - pending review.

WASM functionality to be implemented shortly.

Design complete.

EMA Oracles

Pallet: https://github.com/galacticcouncil/warehouse/tree/main/ema-oracle

GitHub PR: #512 (HydraDX integration) - MERGED

Description: This feature provides exponential moving average (EMA) oracles of different periods for price, volume and liquidity for a combination of source and asset pair based on data coming in from different sources.

Notes:

Audit by Runtime Verification ongoing.

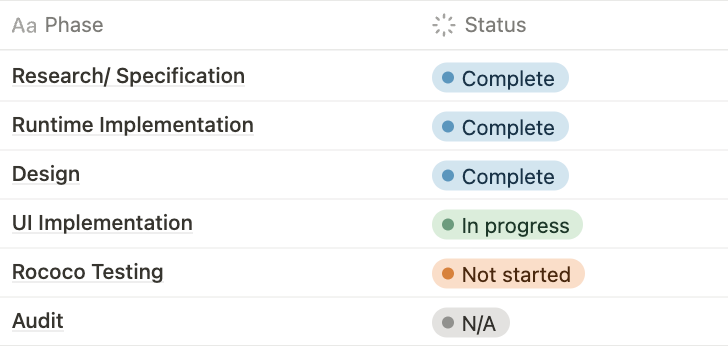

DCA

Description: This feature allows users to gradually accumulate / distribute an asset position without incurring major slippage, achieving better average pricing. Protocols and project teams can also leverage this to diversify their treasury holdings.

Notes:

Runtime implementation complete - reviews complete. Minor changes underway.

Design complete and UI implementation has begun.

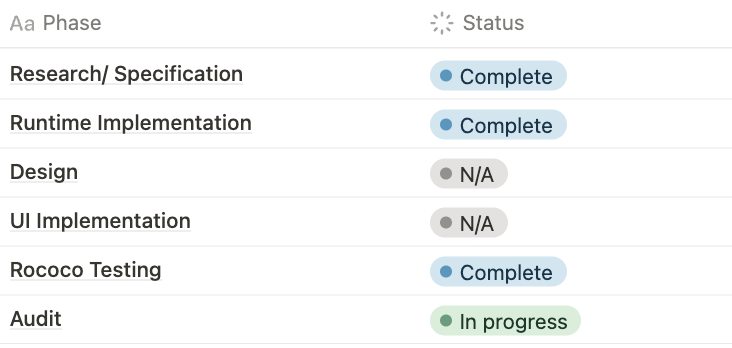

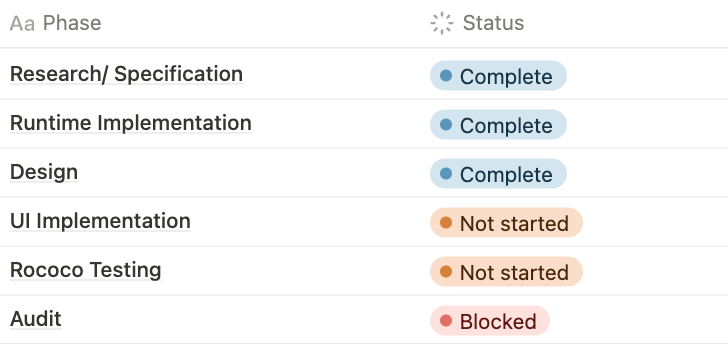

Stableswap Pools

GitHub PR: #508

Description: This feature allows for creation of Stableswap Pools - closely pegged assets traded based on a different invariant curve (similar to Curve Protocol) - within the Omnipool. This is most ideal of stablecoins and liquid staking derivatives (i.e. stDOT).

Notes:

Runtime implemented and awaiting audit.

Design complete pending UI implementation.

Liquidity Mining

Description: This feature allows for distribution of rewards to deposited LP positions in the Omnipool. Multiple farms can be set up to reward the same LPs - e.g. HDX & DOT rewards to DOT LPs in the Omnipool.

Notes:

Minor bug identified on Basilisk, patch applied to HydraDX.

Liquidity Mining can go live once

addLiquidityis re-enabled on mainnet.

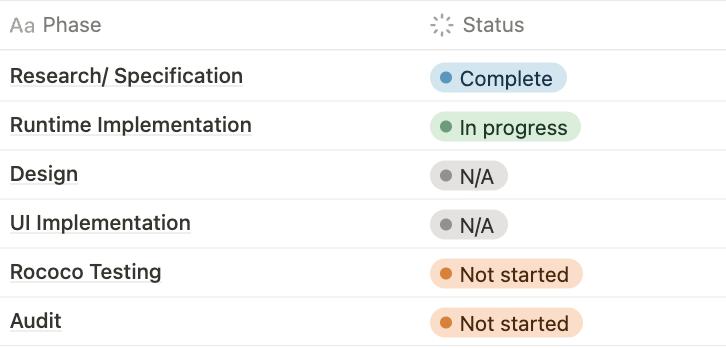

XCM Rate Limiter

Description: Security feature to limit the rate of both inbound and outbound transfers. A key use case would be to limit token transfers of an exploited token to HydraDX and prevent the exploiter from draining other assets with this token.

Notes:

Created PR and discussing with Parity wrt possible implementations.

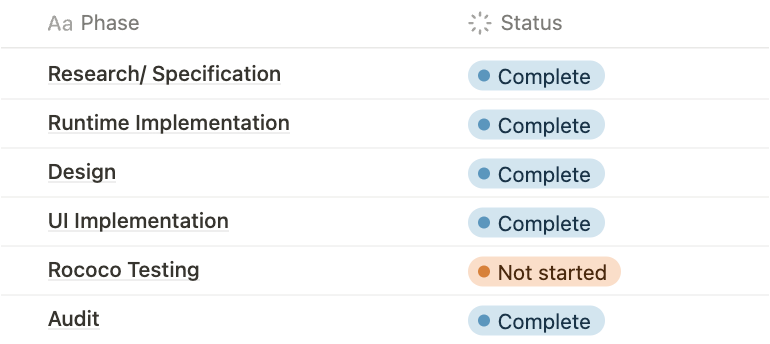

HDX Staking

Description: Non-inflationary staking mechanism for HDX to secure the network from potential malicious governance activity. Yields for HDX stakers will be generated from on-chain activity - other factors such as time locked and governance participation will impact individual reward rates.

Notes:

Specification agreed for initial implementation - designed to allow additional features at later date.

Other developments

Upgrade to Substrate v0.9.38 PR: #546

Includes XCMv3

Development of API infrastructure to provide data such as Omnipool pricing to e.g. CoinGecko HydraDX API

Governance Square

A selection of recent governance proposals. Proposals where vote totals/controversy are not discussed can generally be assumed to have passed overwhelmingly (>90% non-abstaining vote*).*

Proposals/ In Discussion

Ref #44 - Open HRMP channels w/ Bifrost & on-chain remark

Passed

Ref #43 - POL Diversification and Deployment (Q2+ 2023)

Ref #42 - Re-distribute Equilibrium HDX crowdloan rewards

Ref #41 - Whitehat Bounty Payment

Ref #40 - Add iBTC, USDT & ZTG to Omnipool

Ref #39 - HRMP channel requests, register ZTG & CFG on HydraDX asset registry

Ref #38 - Withdraw DAI & WBTC from Acala to HydraDX treasury & create OTC orders

DOT+Ecosystem Partners News

HydraDX Omnipool Basics

Want to join HydraDX?

We're a group of skilled builders, operators, and meme connoisseurs with a goal to create the most exceptional liquidity hub for Web3. We are laser focused on delivering community-first, user-focused, and impactful products and features. If you are interested in joining us, reach out on Discord.

About HydraDX

HydraDX is the go-to decentralized trading platform native to the Polkadot ecosystem. HydraDX’s Omnipool offers the lowest slippage dollar-for-dollar per TVL for traders and the most flexibility in deploying their capital for LPs. Visit HydraDX to learn more and discover how we are bringing an ocean of liquidity to Polkadot and DeFi.

Twitter | Discord | Telegram | Newsletter | Monthly Update | Youtube (soonTM)