Welcome to the HydraDX Monthly Update, where you can keep track of all things HydraDX. In conjunction with the monthly newsletter, live AMA Office Hours will be held in Discord during the following times on Apr 6th:

3pm UTC (8am/11am PST/EST; 11pm HKT/SGT)

7/10pm PST/EST (10am HKT/SGT - Apr 7th)

For those who are unable to attend Office Hours, there will be two 1-hour text-based AMA sessions occurring:

Chinese - 9pm HKT/SGT Thursday (Apr 6th) in WeChat

English - 11am UTC Friday (Apr 7th) in Discord

If you haven’t subscribed, join us:

Slowly but Surely

Gm! With SVB and its aftermath capping off 1Q23, this crisis was yet another reminder of why crypto exists and needs to. Striving towards a more transparent and permissionless system is what DeFi is all about. While the destination is still unknown and the journey still ever-so long, we can at least be sure that this latest crisis and those that come after it will continue the slow but sure march of mass adoption by the average joe into crypto and DeFi.

For HydraDX, this past month was also not all rainbows and unicorns but our technical contributors have weathered the storm and the Protocol now looks onwards to upcoming feature releases mentioned below.

As usual if there is any feedback on what our team can do better, please do drop us a comment in Discord.

Without further adieu, let’s get into it! 🐉🐉🐉🌊🌊🌊

Key Protocol Updates

Security Update #1

After announcing our Immunefi Bug Bounty program last month, HydraDX recently received a bug report by a whitehat which helped identify a potential attack vector for the Omnipool - which if exploited, may have led to a potential loss of funds.

Soon after receiving this report, technical contributors of the Protocol worked to engineer a long-term solution to mitigate the points raised. On Mar. 23, the proposed solution was passed by governance and implemented immediately. The number of changes made were wide-ranging and include:

On-chain Oracles

Circuit breakers, and

Per-block limits

If you read our monthly update last month, a number of these security features was already in development; hence we were able to implement the solution so quickly. After some further testing, we expect that adding liquidity to the Omnipool will be available again. In the meantime, please bear with us and stay tuned!

For further detail into the specific bug, check 👉 Security Update #1

OTC Tradoooor and Liquidity Mining (Referendum #37)

In conjunction with the security features mentioned in Security Update #1 and above, governance approved Referendum #37, which included a handful of other features that will start making its way to mainnet in the upcoming weeks:

OTC Tradooooor

Liquidity Mining

OTC Tradooooor will allow the Protocol and community to trustlessly swap one asset for another, outside of Omnipool. The first specific use-case for this is for the Protocol to swap DAI for native USDT and to swap WBTC for @InterlayHQ’s iBTC. HydraDX will also be incentivizing community members who help us swap for certain assets using the OTC Tradooooor, so be on the lookout for that!

As for Liquidity Mining, it went live on Basilisk last month for us to work out some final kinks. We expect this to be rolled out in the upcoming weeks.

In the meantime, public testnet for OTC Tradoooor is live with Liquidity Mining to follow shortly in the next week or so, check it out 👉 here.

Development Progress Hub

A selection of development updates on various items in progress. The updates span over a month and is ordered chronologically (as much as possible) for each item.

Partnerships / Business Integrations / Operations

Project Treasury LP (aka. Hydrate Your Treasury)

Partnering with interested parachains to deploy part of their token supply into the Omnipool as a LP to help reduce their liquidity budget.

Confirmed with Astar and Zeitgeist

Centrifuge will soon start discussion and undergo their own governance process for approval

Polkadot Assurance Legion (PAL)

HydraDX is leading a new ecosystem initiative which will pool together funds to help parachains undergo rigorous audits.

Initial members of PAL include: HydraDX, Interlay, Astar Network, Manta Network, Bifrost, Acala, Centrifuge, Zeitgeist and Equilibrium.

Besides audits, PAL will drive the adoption of various methods for (formal) verification and the development of tooling.

Submitted proposal on 3/30 for the Polkadot treasury bounty for discussion here: https://polkadot.polkassembly.io/post/1752

Product Features / Cross-chain / Infrastructure

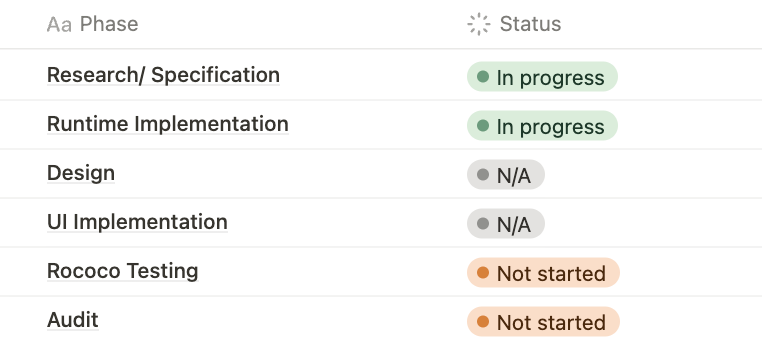

OTC Tradooooor

Description: This feature allows whales and traders to buy/sell any amounts of an asset at a predetermined price; for the Protocol, this will allow HydraDX to purchase native tokens (i.e. USDT) in a decentralized and trustless manner.

Notes:

Runtime implemented alongside security upgrade.

Rococo testing commenced Friday 31st March.

POL OTC orders approved through Referendum #38 & live now

Dynamic Fees

GitHub PR: #163

Description: This feature allows the Protocol to be able to charge varying fees based on volatility (via. price and volume oracle data); this increases profitability for LPs, including HydraDX’s POL position, who are hit harder in volatile trading environments.

Notes:

Runtime implementation of dynamic fees pallet complete.

Omnipool integration & WASM functionality to be implemented shortly.

Design requirements are trivial.

EWA Oracles

Pallet: https://github.com/galacticcouncil/warehouse/tree/main/ema-oracle

GitHub PR: #512 (HydraDX integration) - MERGED

Description: This feature provides exponential moving average (EMA) oracles of different periods for price, volume and liquidity for a combination of source and asset pair based on data coming in from different sources.

Notes:

Runtime implemented as part of the recent security upgrade - facilitates within-block limits on trading volume & add/ remove liquidity operations.

Pallet fuzz-tested by SR labs before deployment to mainnet.

Pending audit in April by Runtime Verification.

DCA

Description: This feature allows users to gradually accumulate / distribute an asset position without incurring major slippage, achieving better average pricing. Protocols and project teams can also leverage this to diversify their treasury holdings.

Notes:

Runtime implementation complete - reviews ongoing.

Finalising design ahead of UI implementation.

Stableswap Pools

GitHub PR: #508

Description: This feature allows for creation of Stableswap Pools - closely pegged assets traded based on a different invariant curve (similar to Curve Protocol) - within the Omnipool. This is most ideal of stablecoins and liquid staking derivatives (i.e. stDOT).

Notes:

Runtime implemented and awaiting audit.

Minor changes to front-end required e.g. router SDK implementation and changes to add liquidity.

Liquidity Mining

Description: This feature allows for distribution of rewards to deposited LP positions in the Omnipool. Multiple farms can be set up to reward the same LPs - e.g. HDX & DOT rewards to DOT LPs in the Omnipool.

Notes:

This feature is currently live on Basilisk and audit is complete.

UI Implementation is complete and Rococo testing will begin imminently.

Liquidity Mining can go live once

addLiquidityis re-enabled on mainnet.

XCM Rate Limiter

Fork: https://github.com/galacticcouncil/cumulus/tree/xcmp-defer-xcm

Description: Security feature to limit the rate of both inbound and outbound transfers. A key use case would be to limit token transfers of an exploited token to HydraDX and prevent the exploiter from draining other assets with this token.

Notes:

Created PR and discussing with Parity wrt possible implementations.

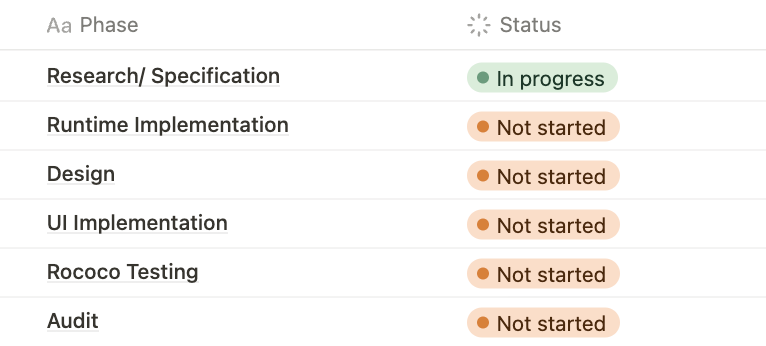

(NEW) HDX Staking

Description: Non-inflationary staking mechanism for HDX to secure the network from potential malicious governance activity. Yields for HDX stakers will be generated from on-chain activity - other factors such as time locked and governance participation will impact individual reward rates.

Notes:

Currently in research & specification phase - narrowed down to a few interesting potential implementations.

Governance Square

A selection of recent governance proposals. Proposals where vote totals/controversy are not discussed can generally be assumed to have passed overwhelmingly (>90% non-abstaining vote*).*

Proposals/ In Discussion

Ref #39 - HRMP channel requests, register ZTG & CFG on HydraDX asset registry

Passed

Ref #38 - Withdraw DAI & WBTC from Acala to HydraDX treasury & create OTC orders

Ref #37 - Add 25M HDX POL to Omnipool, Support for LM, Oracles, OTC Tradooooor & various security features

Ref #36 - Add ASTR to asset registry

Ref #35 - Proposal to fund the upcoming 2 years of development for the Protocol

DOT+Ecosystem Partners News

Bifrost is launching vFIL, one of the first LSD options for Filecoin

Blockspace & Composability Presentation @ Shared Security Summit by @rphmeier

HydraDX Omnipool Basics

Want to join HydraDX?

We're a group of skilled builders, operators, and meme connoisseurs with a goal to create the most exceptional liquidity hub for Web3. We are laser focused on delivering community-first, user-focused, and impactful products and features. If you are interested in joining us, reach out on Discord.

About HydraDX

HydraDX is the go-to decentralized trading platform native to the Polkadot ecosystem. HydraDX’s Omnipool offers the lowest slippage dollar-for-dollar per TVL for traders and the most flexibility in deploying their capital for LPs. Visit HydraDX to learn more and discover how we are bringing an ocean of liquidity to Polkadot and DeFi.

Twitter | Discord | Telegram | Newsletter | Monthly Update | Youtube (soonTM)

Good