Welcome to the HydraDX Monthly Update, where you can keep track of all things HydraDX. If you haven’t subscribed, join us:

Contents

Links above do not work on mobile.

GM to a New Beginning

GM! As many of you know, HydraDX kicked things off for the year with the launch of the Omnipool AMM in January, which now has over $6.0M in total valued locked (TVL). But to us, this is just the beginning of our journey in becoming the liquidity hub of DeFi.

With the launch out of the way, we took the time to reflect on how we can better serve our community; not just through delivering new products & features but all aspects, including community engagement, fostering awareness, and higher transparency.

Monthly Update Newsletter (1st Tuesday after month-end)

After internalizing the community feedback, we are happy to announce today the inaugural edition of our Monthly Update newsletter. This newsletter will be used to recap all the latest happenings, including feature releases, development updates, governance changes, and broader ecosystem news. To ensure consistency, this monthly update will be released the following Tuesday after every month-end.

The HydraDX blog newsletter in its current form will remain as-is and reserved for our most important of announcements, feature discussions and community proposals.

Office Hours (1st Thursday after month-end)

In tangent with the Monthly Update newsletter, the GC team will also be hosting Office Hours on Discord via two sessions on the Thursday (2 days after) post-update release.

4pm UTC (8am/11am PST/EST; 12am HKT/SGT on Fri)

7/10pm PST/EST (11am HKT/SGT on Fri)

This will be a 1-hour fireside voice chat with a quick recap of the written update as well as a public forum for the community to come in, vibe and ask questions about all things HydraDX.

Monthly Text-based AMA

For those who are unable to attend the Office Hours live format, an additional monthly 1-hour text-based AMA session will occur on the following dates post-update release.

Chinese* - 9pm HKT/SGT Thursday (2 days after monthly update)

English - 12pm UTC Friday (3 days after monthly update) on Discord

*For our Asia-based Chinese speaking community, the session will be held in our community WeChat group. Please reach out in our Chinese channel on Discord to learn more.

As usual if there is any feedback on what our team can do better, please do drop us a comment in Discord.

Without further adieu, let’s get into it! 🐉🐉🐉🌊🌊🌊

Key Protocol Updates

The Future is Hydrated

With v1 of the Omnipool soon to be fully delivered, a proposal has been made for the repurposing of $5.0M from the liquidity bootstrapping pool (LBP) funds to support further development of the Protocol over the next 2 years. To ensure incentive alignment, the GC team has proposed to distribute the funds in instalments that represent no more than 6 months' runway.

This additional funding is essential for the Protocol’s growth and development on all fronts, including (but not limited to): new products/features, research, marketing, and audits. For products/features specifically, the funding will help bring to life the following:

Near-term

Dollar-cost averaging: Set-and-forget feature for those who want to gradually accumulate / distribute an asset position without incurring major slippage, achieving better average pricing. Protocols and project teams can also leverage this to diversify their treasury holdings.

Dynamic fees: The ability to charge varying fees based on volatility (via. price and volume oracle data); this increases profitability for liquidity providers (LPs), including HydraDX’s own protocol-owned liquidity (POL), who are hit harder in volatile trading environments.

HDX Staking: Incentivize staking of HDX in a sustainable manner. We have identified several ways to achieve this and are in the works to confirm on the development direction. Be on the look-out for more on this in due course.

Longer-term

Bonds

Money Market

Liquidation Engine

Order Batching

Payment for Order Flow

Learn more 👉 The Future is Hydrated

Follow-up AMA on March 2nd

Following the recent blog post “The Future is Hydrated”, HydraDX founder, Jakub Gregus, sat down with @lolmcshizz and had an AMA fireside chat to answer questions from the community. A recording of the AMA can be seen here.

We have also completed a transcript summary here: March 2nd AMA - Summary

HydraDX Bug Bounty Program

HydraDX is calling upon all savvy bug bounty hunters out there to help us fortify our defenses against potential vulnerabilities. The Protocol is offering hefty bounties (up to $1M) to those who can sniff out any critical or high-level vulnerabilities in our system, with minimum rewards of $5,000 for web/app bugs and $50,000 for critical blockchain/DLT vulnerabilities.

Confirmation of any bugs/fixes will be handled by the GC team on behalf of the Protocol with payouts handled by the HydraDX Council and paid in HDX for the equivalent US$ amount. With regard to blockchain/DLT vulnerabilities, only code involving runtime pallets of HydraDX and pallets developed by Galactic Council are considered as in-scope of the bug bounty program.

Happy hunting 👉 HydraDX Bug Bounties

Liquidity Mining on Basilisk

To dip its toes into the capabilities of Hydrated Farms, Basilisk - the sister-chain of HydraDX - kicked off its inaugural liquidity mining program on Feb 18. This will be an initial 3-month sprint with the first set of farms on Basilisk to include:

BSX-USDT

BSX-KSM

BSX-TNKR

The program may be expanded into other existing and/or new pools that come live later. This initial set of farms on Basilisk also allows us to work out the final kinks before launching Hydrated Farms on HydraDX 😉. As mentioned before, we don’t foresee liquidity mining as a long-term staple in bootstrapping liquidity so enjoy it while it lasts!

Start up your tractors 👉 Pools & Farms on Basilisk

Development Progress Hub

A selection of development updates on various items in progress. The updates span over a month and is ordered chronologically (as much as possible) for each item.

Product Features / Cross-chain / Infrastructure

OTC Tradooooor

Description: This feature allows whales and traders to buy/sell any amounts of an asset at an agreed price; for the Protocol, this will allow HydraDX to purchase native tokens (i.e. USDT) in a decentralized and trustless manner.

Notes:

Runtime implementation is completed and being reviewed.

Front-end in progress with designs complete and UI implementation nearing completion.

Ready to be deployed soon after final checks and testing.

Dynamic Fees

GitHub PR: #163

Description: This feature allows the Protocol to be able to charge varying fees based on volatility (via. price and volume oracle data); this increases profitability for LPs, including HydraDX’s POL position, who are hit harder in volatile trading environments.

Notes:

Specification complete with modelling ongoing to determine best parameters for decay function and range input.

Runtime implementation of dynamic fees pallet complete pending final parameters, adjustment to Omnipool pallet required.

Dependency on Oracles pallet.

EWA Oracles

Pallet: https://github.com/galacticcouncil/warehouse/tree/main/ema-oracle

GitHub PR: #512 (HydraDX integration)

Description: This feature provides exponential moving average (EMA) oracles of different periods for price, volume and liquidity for a combination of source and asset pair based on data coming in from different sources.

Notes:

Pallet merged and ready to deploy on Basilisk.

Integration for HydraDX in progress and awaiting subsequent audit.

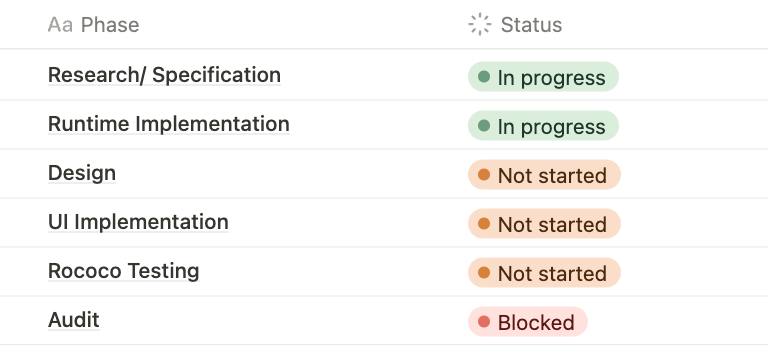

DCA

Description: This feature allows users to gradually accumulate / distribute an asset position without incurring major slippage, achieving better average pricing. Protocols and project teams can also leverage this to diversify their treasury holdings.

Notes:

Finalising runtime implementation, with reviews ongoing.

Design awaiting final tweaks based on final runtime implementation - after which, UI implementation can begin.

Stableswap Pools

GitHub PR: #508

Description: This feature allows for creation of Stableswap Pools - closely pegged assets traded based on a different invariant curve (similar to Curve Protocol) - within the Omnipool. This is most ideal of stablecoins and liquid staking derivatives (i.e. stDOT).

Notes:

Runtime implemented and awaiting audit.

Minor changes to front-end required e.g. router SDK implementation and changes to add liquidity.

Liquidity Mining

Description: This feature allows for distribution of rewards to deposited LP positions in the Omnipool. Multiple farms can be set up to reward the same LPs - e.g. HDX & DOT rewards to DOT LPs in the Omnipool.

Notes:

This feature is currently live on Basilisk and audit is nearing completion for the HydraDX Omnipool adaptor.

UI Implementation will shortly be deployed for testing on Rococo.

XCM Rate Limiter

Fork: https://github.com/galacticcouncil/cumulus/tree/xcmp-defer-xcm

Description: Security feature to limit the rate of both inbound and outbound transfers. A key use case would be to limit token transfers of an exploited token to HydraDX and prevent the exploiter from draining other assets with this token.

Notes:

Update to Cumulus package which would add a new configurable filter called XcmDeferFilter - this can be used to defer xcm messages.

The return value of the filter is the number of blocks you want to delay the xcm message with.Partnerships / Business Integrations / Operations

Partnerships / Business Integrations / Operations

Project Treasury LP (aka. Hydrate Your Treasury)

Partnering with interested parachains to deploy part of their token supply into the Omnipool as a LP to help reduce their liquidity budget

Pitch deck completed

Initial meetings completed with Astar, Bifrost, Centrifuge, Phala, and Zeitgeist.

Polkadot Assurance Legion (PAL)

HydraDX is leading a new ecosystem initiative which will pool together funds to help parachains undergo rigorous audits.

Initial members of PAL include: Interlay, Astar, Manta, Acala, Centrifuge and Zeitgeist.

Besides audits, PAL will drive the adoption of various methods for (formal) verification and the development of tooling.

The proposal for the Polkadot treasury bounty is almost complete, it is soon to be published for discussion.

Governance Square

A selection of recent governance proposals. Proposals where vote totals/controversy are not discussed can generally be assumed to have passed overwhelmingly (>90% non-abstaining vote*).*

Proposals/ In Discussion

Ref #35 - Proposal to fund the upcoming 2 years of development for the Protocol.

Set aside 5.0M DAI from LBP funds to extend the development runway of the HydraDX Protocol for the upcoming 2 years. The funds will be distributed by the HydraDX Council in instalments equivalent to no more than a 6 months' runway. Dedicated post here.

Passed

Ref #34 - Increase TVL cap to $10.0M, LP POL, adjust asset weight caps

Ref #32 - Increase TVL cap to $8.0M, LP POL, adjust asset weight caps, open HRMP channel with Centrifuge, and accept HRMP channel with Astar

Ref #31 - Increase TVL cap to $6.0M, LP POL, adjust asset weight caps

Ref #30 - Bridge POL (306 WETH, 600 000 DAI & 11 WBTC) from Acala to HydraDX parachain

Ref #29 - Increase TVL cap to $4.0M, LP the POL from Ref#54, adjust asset weight caps

Ref #28 - Open HRMP channels with Phala & Interlay

Ref #27 - Bridge POL (316.45 WETH, 500k DAI & 13.09 WBTC) from Acala to HydraDX parachain

DOT+Ecosystem Partners News

HydraDX Omnipool Basics

Want to join HydraDX?

We're a group of skilled builders, operators, and meme connoisseurs with a goal to create the most exceptional liquidity hub for Web3. We are laser focused on delivering community-first, user-focused, and impactful products and features. If you are interested in joining us, reach out on Discord.

About HydraDX

HydraDX is the go-to decentralized trading platform native to the Polkadot ecosystem. HydraDX’s Omnipool offers the lowest slippage dollar-for-dollar per TVL for traders and the most flexibility in deploying their capital for LPs. Visit HydraDX to learn more and discover how we are bringing an ocean of liquidity to Polkadot and DeFi.

Twitter | Discord | Telegram | Newsletter | Monthly Update | Youtube (soonTM)